Keep At It For A Full Recovery

© International Monetary Fund

By Krishna Srinivasan and Peter Breuer

Sri Lanka is emerging from an unprecedented economic crisis that imposed significant hardships on its people, especially the most vulnerable. We saw some of these effects in our own travels around the country, as well as some signs of recovery, as we work to help rebalance the economy.

The economy grew 1.6 percent from a year earlier in the third quarter of 2023, the first expansion in a year and a half. Inflation has moderated significantly and other economic indicators, such as those for manufacturing and services, add to signs of a broadening recovery. We recently projected that the economy will expand this year and that growth will accelerate next year.

Sri Lanka turned to the IMF to contain the 2022 crisis and build a foundation for sustainable and inclusive growth. Together, the country and the IMF agreed on a comprehensive economic reform program to address the causes of the crisis and look after those hurt most by the crisis.

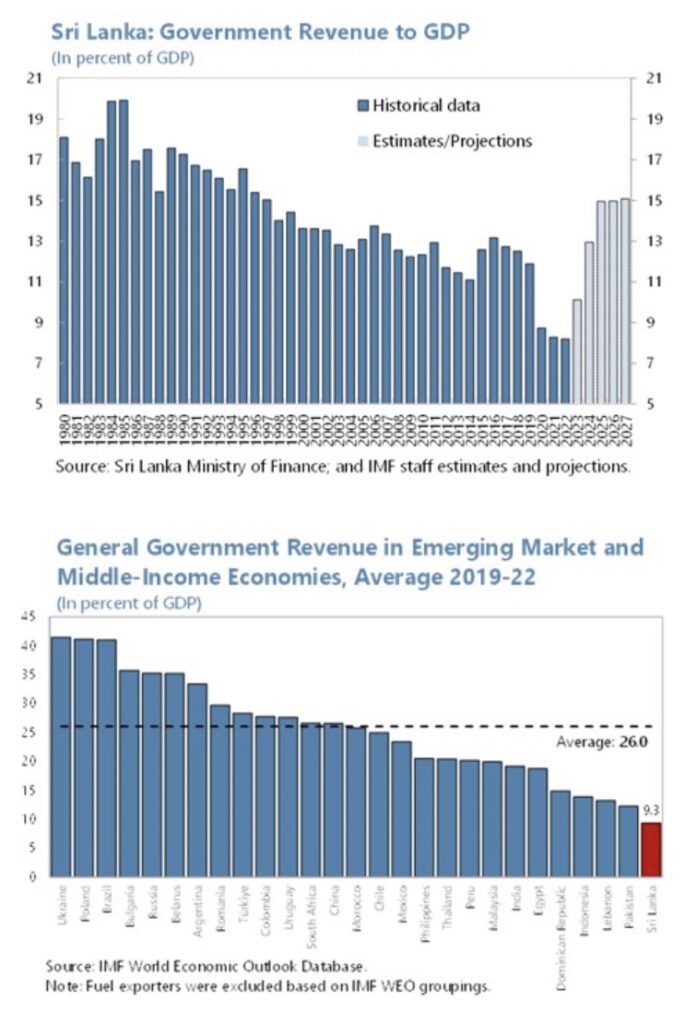

Addressing a crisis of this depth requires commitment and strong collective efforts by everyone. An essential part of this effort is restoring government revenue to sustainable levels, more in line with Sri Lanka’s past (Chart 1) and peers (Chart 2). Raising revenue is key to narrowing the gap with expenditures, to attracting partners willing to finance essential services, and to creating space to restart economic growth by bringing down inflation and interest rates. This, in turn, will attract investment, further boosting growth. More work is needed to restore tax revenue to a sustainable level and to prevent the 2022 crisis from repeating itself. Sri Lanka will need to resolutely implement reforms to help achieve a complete recovery.

IMF financing has helped avoid more severe outcomes, as we witnessed in 2022 before the IMF program when government spending was more than twice its revenue. With spending on health, education, and other essential services at risk of large cuts, and no access to foreign financing, the government borrowed on domestic markets and from the central bank. That raised domestic interest rates and fueled rapid inflation, curbing lending and growth. IMF financing provides time for reforms to work, catalyzes additional financing from other multilateral and bilateral partners, and is expected to assure creditors that debt repayment capacity can be restored and that the reforms merit debt relief.

As the country addresses some of the main causes of the crisis the recovery remains fragile. Tight borrowing conditions and reduced disposable income hold back consumption. More time and continued reform efforts are needed for people to feel the benefits of these initial green shoots because of how deeply the crisis affected the living standards. When uncertainties associated with the external debt restructuring and the stability of the policy framework are resolved, domestic financing conditions should ease, allowing the nascent recovery to become more broad-based.

Everyone will have to pitch in for all to enjoy the fruits of these efforts. Those who are better off will need to contribute more so the government can provide essential services and help those most in need. Working together is also needed to help eliminate corruption and inefficiency. Corruption, tax exemptions, and non-competitive procurement and allocation practices imply higher taxes and costs for everyone, hitting the most vulnerable hardest. The ongoing efforts to implement the recommendations of the IMF Governance Diagnostic Report—the first in Asia—will help to reduce these losses for the benefit of everyone. Prevention also requires providing a safe space for public engagement in governance.

There is light at the end of the tunnel. Although it may seem as small as a pinhole at the moment, continued reforms will accelerate passage through the tunnel and allow this light to become bigger and bigger. Maintaining the reform momentum is Sri Lanka’s best hope for recovering from one of its most severe economic crises.